There’s never a good time to reduce ad spend, but the challenges and uncertainties brought on by the COVID-19 pandemic were too great for most brands to ignore, driving widespread advertising cutbacks across channels and markets. The pause in spend likely had an adverse effect on brand awareness for many companies, which means that now is the time to get back in the game—but with a strategic, well-balanced approach.

It’s atypical for brand awareness to drop to zero—even when brands go dark for long periods—but brand awareness does decay, which is why it’s normal to see very well-known brands maintain robust ad campaigns even during normal market conditions. Their sole goal is to combat decay. So it’s likely that much of the uptick in U.S. advertising that occurred in August was focused on awareness rather than activation.

And that’s something that should continue as the ad market continues to come back online. On average, it takes three to five years to recover equity lost because of halted advertising, and long-term revenue can take a 2% hit for every quarter a brand stops advertising. Brand building and awareness campaigns are critical in long-term success, and companies that were able to frugally maintain their marketing efforts through the past three historic ad shocks were able to protect up to 9% of total sales annually. Said plainly, playing the long game is critical. In fact, the long-term impact of marketing is 88% higher than the short-term impact.

Sometimes it takes a bit of experimentation to get the balance right. For example, global sports brand Adidas reported last October that it needed to pivot after over-extending itself across digital channels and performance marketing in an effort to super-charge ROI. Ultimately, it found that the focus on cutting back had a negative effect on brand awareness.

Transitioning from Awareness to Interest

Interest is the other critical top funnel consideration, and it’s closely linked to awareness. Nielsen sales forecast data shows that there is a nearly linear relationship between interest and sales (e.g., a 10% increase in interest will lead to a 10% increase in sales). Given the upended nature of the world in 2020, it’s not surprising to see brands pulling back, hedging their spending and focusing on sure bets, like digitally delivered discounts and direct-mailed promotions to current customers. Those activation-oriented tactics are important, but they don’t work in isolation. They also might not work in situations where companies paused brand awareness efforts amid market uncertainty.

Understanding consumers’ reality is also critical. Given the depressed economy and resultant job losses, pitching financially constrained consumers with activation-geared marketing efforts after a period of silence might not generate the desired response. It could even turn consumers off for good. For example, in our “Adapting to a New Normal” webinar earlier this year, we noted that 41% of consumers are more likely to buy from a brand that uses its advertising to explain what it’s doing to help its employees and customers.

Given the state of the media and advertising landscape, it’s likely that brands need to focus on balancing brand building with sales-driving initiatives, but no marketer should ever make channel and allocation decisions without proper metrics. Marketers need to balance brand building and activation. They are not interchangeable, and focusing on one over the other without proper measurement metrics can lead to inefficient spending.

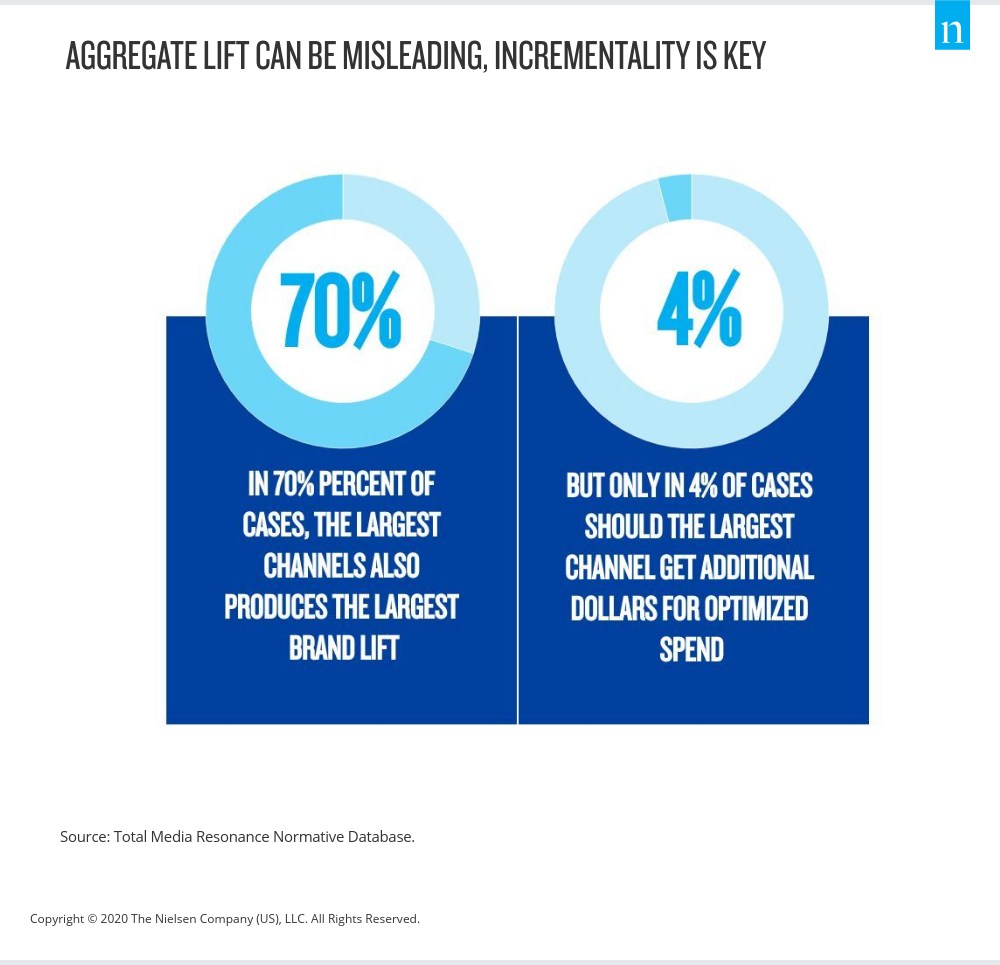

It’s also not wise to simply add additional spending to the areas that drive the greatest brand lift. Data from Nielsen Total Media Resonance shows that the channel with the greatest spend drives the greatest lift 70% of the time. So a brand should expect its biggest channel to drive the greatest brand lift, but that doesn’t mean additional spend there will automatically drive incremental lift. It likely won’t. In fact, the channel with the greatest lift only has the greatest marginal efficiency 24% of the time. And according to Total Media Resonance analyses, increasing investment in your largest channel is actually an ineffective choice for growing brand health in 96% of cases.

Marketing is a give and take between brand building and sales activation, but amid a global pandemic that has flipped all aspects of daily life for consumers—and will likely continue to do so for the foreseeable future—marketers need accurate measurement, with a key focus on optimization, in order to know how to adjust their initiatives in a rapidly evolving environment. Sales-activation strategies may drive short-term gains, but Nielsen Marketing Mix Modeling analyses show that about half of the sales impact from marketing comes long after an initial campaign launch, highlighting the powerful force that brand building has on bottom-line sales.