Also known as the “Big Game” in the U.S., the Super Bowl is typically one of the most viewed TV moments. In fact, in 2024 Super Bowl LVIII, featuring the Kansas City Chiefs and the San Francisco 49ers, had the largest TV audience for a single-network telecast. It’s also a sports event that audiences will frequently watch together. But it’s not the only programming audiences gather for. Our research shows that Americans watch TV with other people (friends, family, even strangers at the bar) 47% of the time, on average, and alone the rest of the time.

Co-viewing—watching TV with at least one other person around—is an integral part of the TV experience and a simple concept to understand, but it’s not easy to measure. As a result, some media planners still use flat co-viewing factors as shortcuts to convert device metrics to individual audiences. What’s a co-viewing factor? Here’s an example: You should expect 1.2 viewers per TV screen at 2PM and 1.5 at 8PM. In today’s fast-changing and highly-fragmented TV marketplace, that is no longer enough.

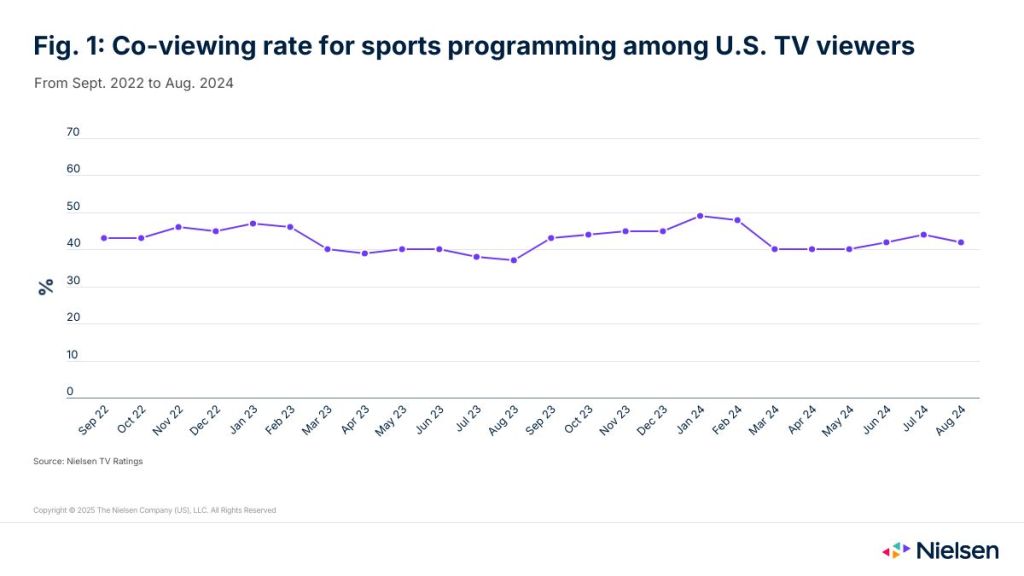

To illustrate how inadequate flat co-viewing factors are, let’s take a look at co-viewing activity during sports programming over the past couple of years.

Le co-visionnage des programmes sportifs varie fortement dans le temps

Figure 1 shows the co-viewing rate (the percentage of total viewing time spent co-viewing rather than viewing alone) for all TV viewers in the U.S. from September 2022 to August 2024, across all sports programming and regardless of platform (broadcast, cable and streaming). The month-to-month variations are substantial, dipping as low as 37% in August 2023 and reaching close to 50% in January and February of 2024.

The peaks correspond to tentpole sporting events, like the Super Bowl or Copa América, but marquee events taking place outside of the U.S. led to comparatively poor co-viewing rates. That doesn’t mean that the 2022 FIFA World Cup in Qatar and the 2023 Women’s World Cup in Australia and New Zealand had poor ratings in the U.S.—quite the opposite, in fact—but it’s more difficult to gather family and friends to watch the matches when they’re broadcast in the middle of the night or in the early morning. As for March Madness, it seemed to attract more alone viewing than average, even though we can see a small bump in co-viewing associated with the record-breaking 2024 tournaments.

Principales lacunes en matière de co-visionnage en fonction de la démographie

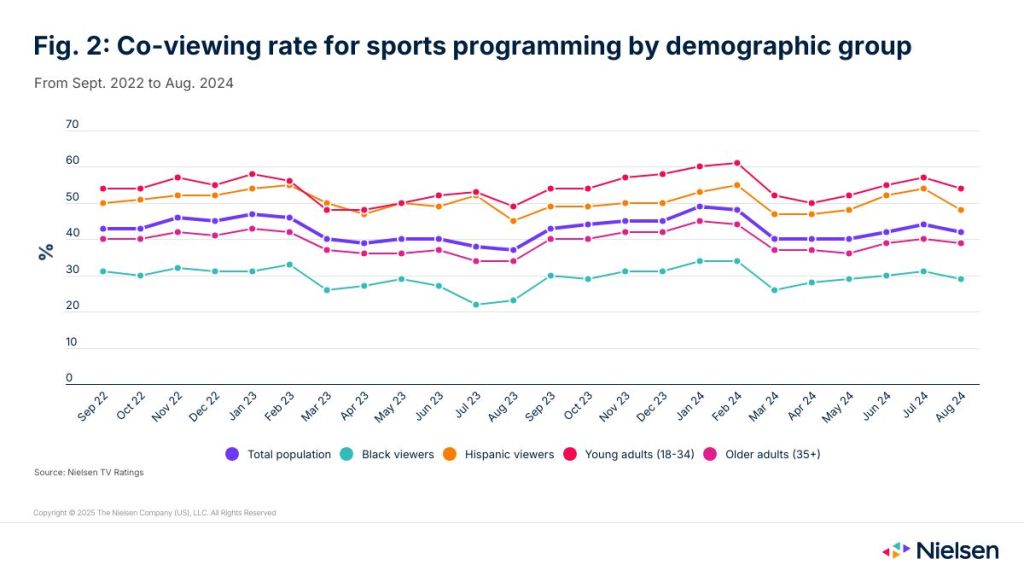

Co-viewing rates vary greatly by demographic group too. For the same two-year time period, figure 2 shows a 20-point gap in co-viewing for sports programs between Hispanic and Black viewers, and a 10 to 15-point gap between younger and older viewers.

Household size is a factor (Hispanic viewers live in larger households), but there are cultural factors at play as well. For instance, young adults might be more willing to go out and watch sports broadcasts with groups of friends. They’re watching considerably less TV than their older counterparts, especially linear TV, but the little they’re watching, they’re doing as a group.

Comment le sport se compare-t-il aux autres genres de programmes ?

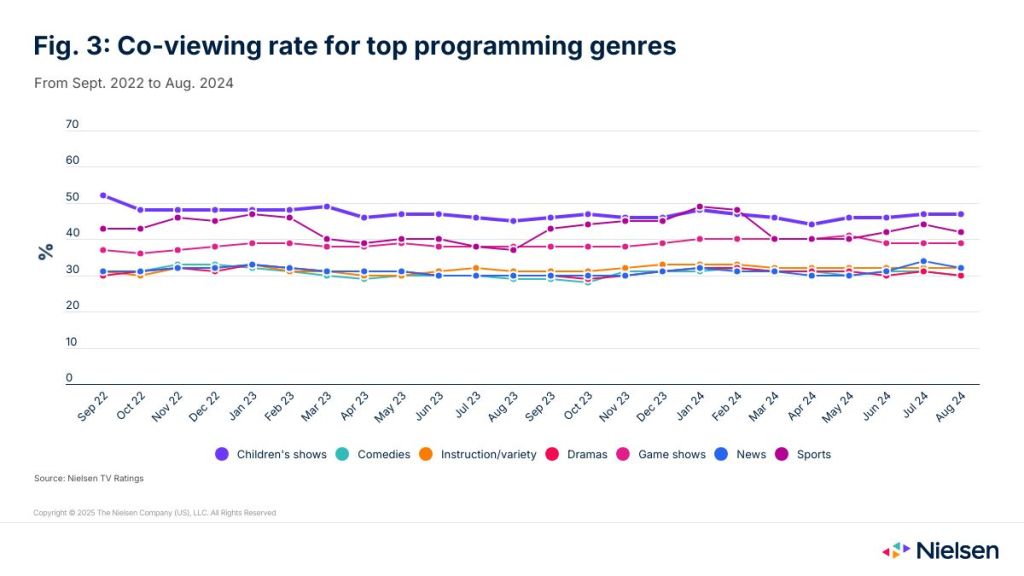

In figure 3, we’re widening the lens a bit to compare co-viewing during sports programs to co-viewing for other top program genres like dramas, news and variety shows.

We can see that over that same two-year time period, children’s shows consistently produced more co-viewing than sports—not surprising considering that kids, especially young kids, often have a parent around when they’re watching TV—and showed more stability over time as well. Game shows performed really well too, a good reminder of the effect that streaming has had in recent years in broadening the genre’s appeal beyond its traditional (read: older) linear TV audience. And the rest of the top programming genres stayed within a narrow co-viewing band just above the 30% mark.

Principales implications pour les annonceurs et les propriétaires de médias

Quelles conclusions devez-vous tirer de ces informations ?

- First and foremost, there’s no such thing as a flat co-viewing factor. That’s clearly evident when we look at sports, but there are subtle variations for other genres as well (and more so if we start to drill down at the program level).

- If you’re an advertiser planning to target a specific demographic group or a more advanced audience, you should throw your co-viewing assumptions out the window and get your hands on co-viewing insights based on actual real-life behavior for that target group.

- If you’re a media owner, understanding whether people are watching alone or with other people can help you finetune your own shows and improve how you monetize your audiences.

Prêt à explorer ce que le co-visionnage peut apporter dans votre monde ?

In a recent blog post, we reviewed how Nielsen’s co-viewing calculations rely on robust people-based measurement solutions inside and outside the house, as well as advanced algorithms to assign viewership to individuals when the only available data comes from devices, as is typically the case with big data from set-top boxes and smart TVs.

Learn more about how and when audiences watch television, or contact us to discover how to use co-viewing to your advantage.