The digital space is a dynamic area for Black audiences, who are increasingly engaging across a multitude of platforms. Streaming services and social media headline how the community consumes content. However, amidst this digital proliferation, radio maintains a remarkable strong hold reaching almost 90% of Black listeners.1 In essence, radio’s ability to reach Black audiences remains a valuable part of the modern media mix.

The value of connecting with Black radio listeners

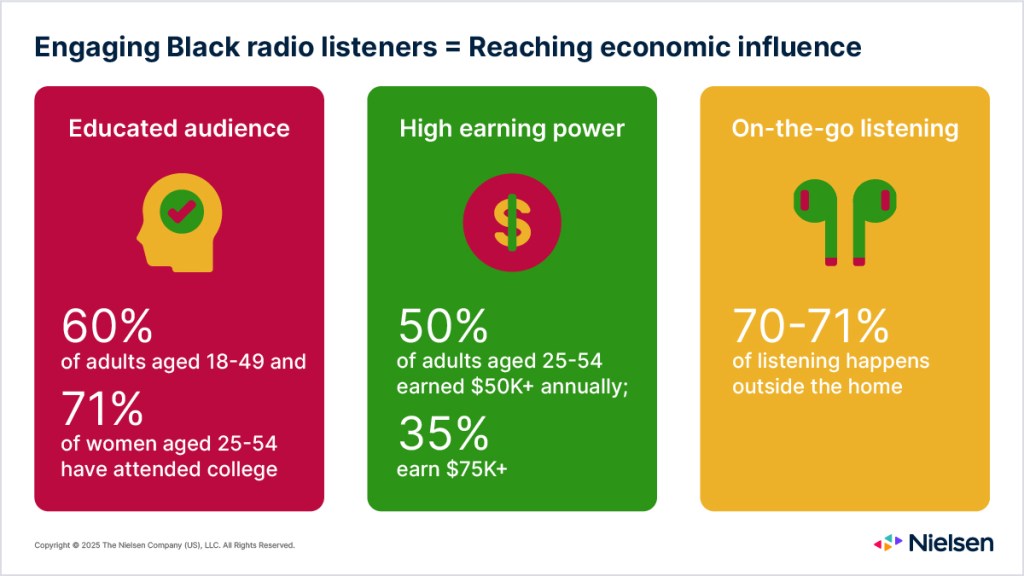

Advertisers who are able to connect with Black radio listeners are engaging with an economically influential demographic that controls significant purchasing power. Black network radio listeners represent a wide range of segments including highly educated and ambitious consumers. Many have attended college, with 60% of adults 18-49 and 71% of women 25-54 having completed at least some higher education. Over half of Black adult listeners aged 25-54 live in households making $50,000+ annually, with 35% reaching the $75,000+ bracket. These listeners overwhelmingly tune in while on the go. Across all age groups, a consistent 70-71% of listening happens outside the home.2

The high out-of-home listening rate means advertisers can connect with Black consumers during their daily activities, potentially closer to point-of-purchase moments. Understanding the profiles of Black audiences allows advertisers to develop more sophisticated, relevant ad content, reaching listeners across various settings—during commutes, at work, or while running errands. The combination of education and buying power suggests an audience likely to be influencers within their communities, offering a wider impact for advertising efforts. In fact, a recent Nielsen analysis found 55% of Black Millennials consider themselves the leader in trends for their friend or peer group.3

The power of radio in the Black community

Radio continues to command an impressive audience, reaching 27.4 million Black adults weekly—an average reach that matches that of connected TV.4 This not only underscores radio’s enduring relevance but also underlines its cultural significance within Black communities. The medium’s widespread engagement contributes to effective advertising, as Black listeners show a higher likelihood to respond to radio advertisements. For example, Black consumers are twice as likely as the other demographic groups to try products promoted on local radio stations, emphasizing radio’s unique ability to influence purchasing decisions.5

Radio’s influential role in Black communities has gained attention from marketers and media buyers. Advertisers have ramped up their investments in Black-owned radio stations, recognizing the medium’s power to forge authentic connections with Black audiences.6 A recent study with a radio network using Nielsen Media Impact found that moving just 20% of existing media mix to their stations delivered the same level of reach in one week that the previous plan delivered in one month.

Urban radio listening trends among Black audiences

A closer look at radio trends shows urban radio is an impactful medium for reaching Black audiences, with its popularity reflected in impressive listener statistics. Every week, nearly 14 million Black adults (aged 18 and older) tune in to urban radio stations. In fact, Urban radio formats account for nearly 50% of all radio listening by Black adults.

The impact of urban radio varies across different age groups and genders. Among Black listeners aged 18 to 49, urban radio captures 52% of their total radio listening time. Interestingly, there’s a notable gender difference within this age group. Women aged 18-49 spend approximately 54% of their radio listening time on urban formats, while men in the same age range dedicate about 50%, indicating a stronger preference for urban radio among female listeners.7

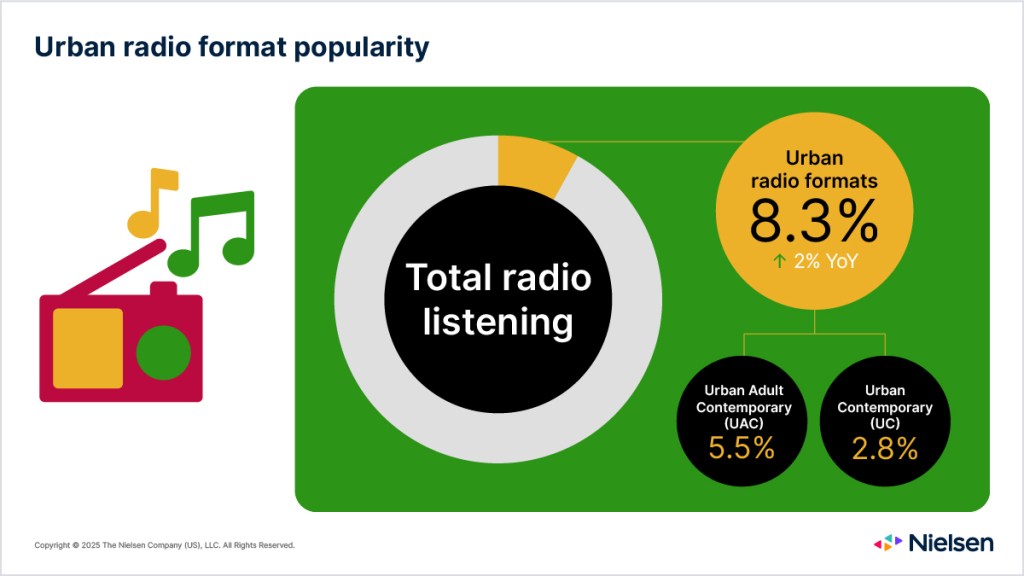

Among the total radio listening universe, Urban AC (Adult Contemporary) and Urban Contemporary collectively account for 8.3% of all radio listening, including both over-the-air and streaming platforms. Urban AC claims 5.5% of the share, nearly double that of Urban Contemporary at 2.8%. Black listeners appear to particularly favor Adult Contemporary within urban radio, possibly due to its mix of current hits and familiar classics. Urban radio formats overall have seen increasing popularity, with reach growing by 2% year-over-year.

Dive deeper: Unlock valuable insights on Black audience engagement

Want to know more? There’s a whole lot more to learn about Black audiences. A more comprehensive analysis is available for you to develop a deeper understanding of this influential demographic. To access these expanded insights and leverage them for your campaigns, download the 2025 Diverse Intelligence Series report “Engaging Black audiences: How brands impact, grow and win with inclusion.”

Notes:

1 Nielsen Audience Measurement Comparable Metrics Q2 2024

2 Nielsen Audio National Regional Database (NRD), Spring 2024, Mon-Sun 5am-12mid, Black Differential Survey Treatment (DST) Metros

3 Nielsen Black Diaspora Study powered by Toluna, 2023

4 Nielsen Audience Measurement Comparable Metrics Q2 2024

5 Nielsen Attitude on Ads Study, 2024

6 Nielsen Ad Intel, Spot Radio Spend for 34 Black-owned AM & FM stations in PPM Markets, Q1-Q2 2023 and Q1-Q2 2024

7 Nielsen National Regional Database, Spring 2024

8 The Record, Q3 2024