Sydney – March 3, 2025 – Nielsen Ad Intel, Australia’s most comprehensive ad spend monitoring service, today released its 2024 Advertising Spend Report, revealing the brands and sectors investing the most in media and the key shifts in trends, year-on-year.

Retail, food, and telecommunications dominated, while financial institutions and automotive made significant gains.

Top 20 advertisers for 2024

1. Harvey Norman, 2. McDonald’s, 3. Woolworths, 4. Amazon.com, 5. Reckitt Benckiser. 6. Hungry Jacks, 7. Chemist Warehouse, 8. Toyota, 9. Coles, 10. KFC, 11. Telstra, 12. Commonwealth Bank, 13. Optus, 14. Disney, 15. Mondelez International, 16. Mitsubishi, 17. Youi, 18. Uber, 19. Apple, 20. ANZ

Monique Perry, Nielsen Pacific MD said: “The Ad Intel spend data for 2024 is pretty telling – marketers aren’t just relying on advertising, they’re pushing it, because they know it works. They know it’s still the best and most economical way of forging lasting connections between brands and consumers. The key is top-tier data. It’s crucial if they want to get the edge on their competition. Nielsen’s extensive data suite has become essential for any brand, agency, advertiser, or marketer focused on using data to stay ahead of the curve, or more importantly, their competition”.

Nielsen Ad Intel’s Pacific Commercial Lead, Rose Lopreiato, added: “Retail remains the powerhouse of ad spend, outpacing all other sectors, but automotive also continues to grow. In an increasingly competitive market, these insights are essential as advertisers refine their strategies and allocate budgets more effectively. Nielsen Ad Intel remains the industry benchmark for tracking advertising investment trends, and gives the clearest, most actionable insights into Australia’s dynamic ad market.”

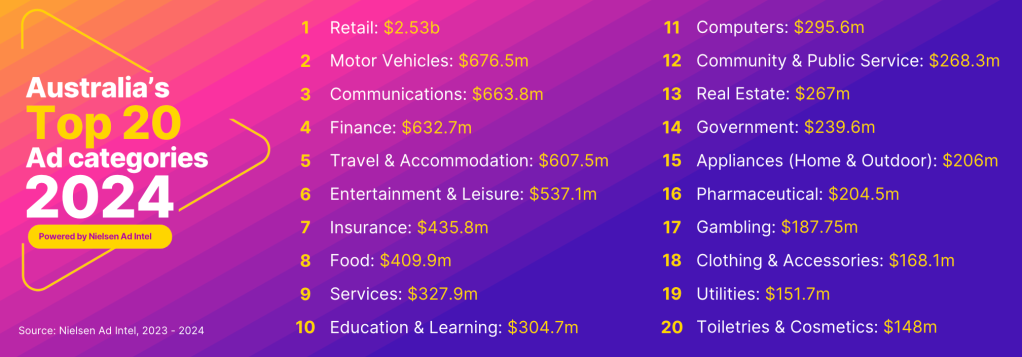

Advertising categories with the highest investment in 2024

Despite economic pressures, advertisers in Australia allocated substantial budgets across various sectors. The leaders were:

1. Retail: $2.53b, 2. Motor Vehicles: $676.5m, 3. Communications: $663.8m, 4. Finance: $632.7m, 5. Travel & Accommodation: $607.5m, 6. Entertainment & Leisure: $537.1m, 7. Insurance: $435.8m, 8. Food: $409.9m, 9. Services: $327.9m, 10. Education & Learning: $304.7m

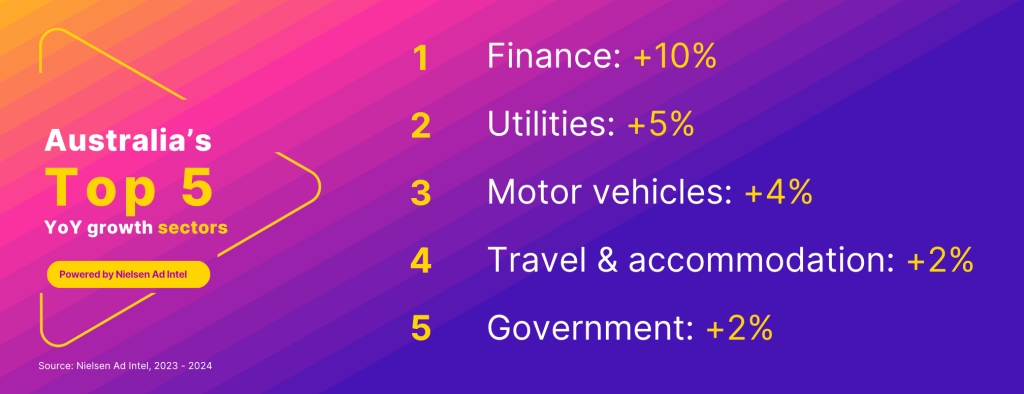

Top 5 Sectors with the highest year-on-year growth

Advertising investment saw growth across multiple industries from 2023 to 2024. Finance led the way with a 10% increase in ad spend. Utilities followed with a 5% rise, while motor vehicles saw a 4% uptick, as both Travel & Accommodation, along with Government, recorded a modest 2% increase.

Advertising in the Government sector is poised for greater growth in 2025 as election-related campaigns ramp up, notably the federal and WA elections.

About Nielsen

Nielsen is a global leader in audience measurement, data and analytics. Through our understanding of people and their behaviours across all channels and platforms, we empower our clients with independent and actionable intelligence so they can connect and engage with their global audiences – now and into the future. Learn more at www.nielsen.com and connect with us on social media (X, LinkedIn, YouTube, Facebook and Instagram).

About Nielsen Ad Intel

Ad Intel provides the most complete source of cross-platform advertising intelligence available today. With intuitive software, review-and-compare ad activity across media, company, category or brand, plus historical data.

Note: Nielsen monitors gross advertising expenditure in major media at published rate card values. While discounts are made available from some media owners, rates are not openly available. Please also note that the category and brand/product groupings figures are grouped at Nielsen’s discretion.

Press Contact

Dan Chapman

dan.chapman@nielsen.com

+61 4040884