In the U.S., the annual Upfront (and Newfront) events put TV media in the center spotlight. This year, we’re diving into the Nielsen data to help the industry understand the trends that are shaping the way we watch.

1. Linear TV still represents the majority of the ad-supported opportunity.

Looking at our most recent classic Gauge report–which represents total use of the television set–you can see that linear TV and streaming are rather close to one another in terms of share. Broadcast and cable combined represent 44.5% of time spent, and streaming represents 43.8%.

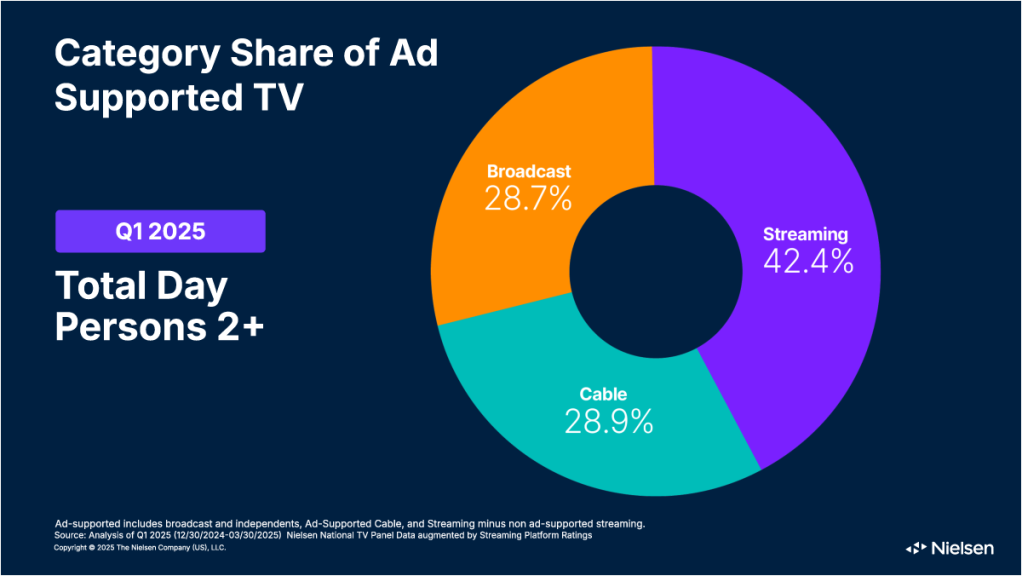

However, when we peel back the onion a bit more and look strictly at ad-supported viewing, we can see that gap gets significantly wider. In our recently released Ad Supported Gauge, broadcast and cable combined account for 57.6% of time spent, while streaming is at 42.4%. So, while streaming certainly continues to gain ground, when it comes to the opportunity to see ads, linear still has a significant lead.

2. TV’s multiplatform opportunity has come into focus.

Streaming permanently changed the television landscape over the last 10 years, and it’s easy to think of things as a competition between the streaming world and the world of broadcast and cable TV. But, when you look at recent viewing data, it turns out it’s more of a “yes, and” conversation (to borrow a phrase from the improv comedy world).

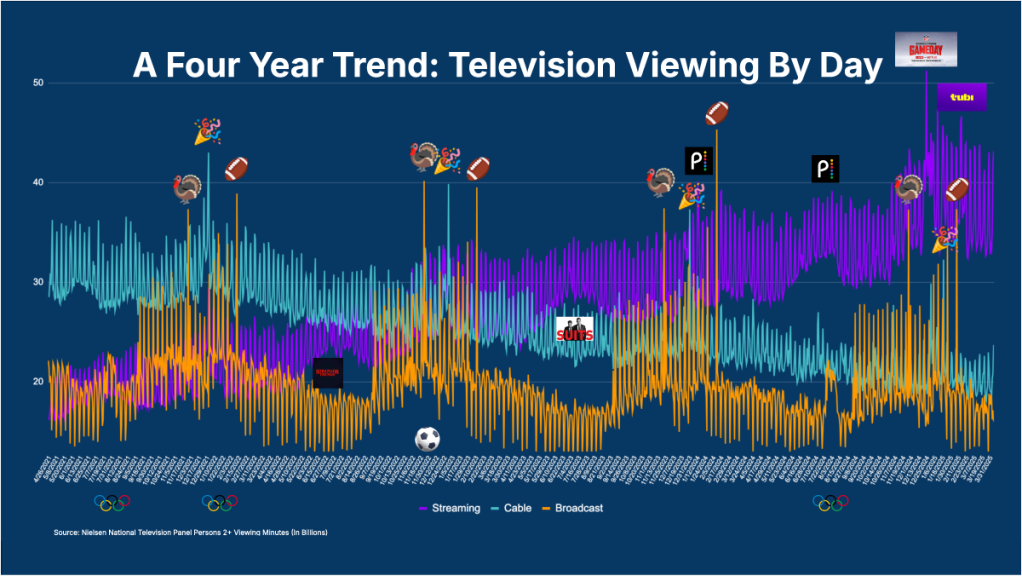

Certainly there are moments when each platform shines: Thanksgiving football and the Super Bowl on broadcast; New Year’s college football on cable; Stranger Things and Suits on Netflix. However, we’ve also seen how the different platforms can work together to really meet different viewers where they are. The 2024 Summer Games are one clear cut example: NBCU’s Peacock delivered live streams and highlights by sport throughout the competition, but NBC’s primetime coverage still saw substantial increases compared to the prior Summer Olympics. This year’s Super Bowl is another: Tubi was able to draw a different but complementary audience relative to FOX’s broadcast.

There are more subtle examples as well. The first season of CBS’s Fire Country launched on Netflix just before the third season premiered on broadcast, and likely reached viewers who hadn’t seen the show previously. Then, when the third season opener landed on Paramount+, it saw a 55% bump in viewership compared to the second season premiere.

And even if we look across an individual company’s television assets and examine viewing by age demographics, we can see where there are opportunities to reach different audiences within a single portfolio. Disney is one example of that dynamic; NBCUniversal and Paramount would be two others.

3. Streaming has gotten increasingly competitive—there are more hits on more platforms.

Netflix remains a powerhouse in the streaming world, but as other platforms mature and content strategies evolve, we’re seeing a wider range of titles land in our top 10 rankings. Five years ago, Netflix carried eight of the 10 top streaming assets, but this past March, we saw a total of seven different companies score entries on the chart. This creates more opportunities for brands to be part of the cultural conversation.

It’s also important to see this in context as originals that attract a big audience tend to peak quickly whereas multi-season titles with deep libraries (e.g. NCIS, Grey’s Anatomy) are critical to hold audiences over time.

4. Sports represent an increasing share of linear TV viewing—but are also driving big numbers for streaming.

In the four year daily viewing trend above, you can see the big spikes in viewing on broadcast and cable around major sports events. But it isn’t just the big moments that are attracting viewers; in fact, sports content has increased its share of viewing on linear TV in each of the last four years. Entertainment content retains the lion’s share, but in 2024, sports approached 20% of total viewing time among adults 25-54. Given how powerful live sports are for both fan engagement and as a promotional platform, it will continue to be a major asset for networks.

All that being said, streamers are certainly part of the sports conversation now, and are seeing it pay dividends. Thursday Night Football on Prime Video averaged over 14 million viewers this past season, and the Christmas Day NFL games on Netflix hit new streaming highs and helped drive total streaming viewership to over 50 billion minutes for the first time on a single day.

5. Multi-language content and deep libraries make streaming a great place to reach diverse audiences.

As we’ve noted in our Black and AANHPI Diverse Intelligence Series reports this year, multicultural consumers are essential for brands to connect with. Linear TV certainly still offers options to reach them–for example, broadcast is particularly important for Hispanic homes–but the depth and breadth of streaming options available today allows audiences to really dig in.

Since Netflix and YouTube carry a lot of international content, it’s not surprising that they represent a significant share of time among diverse audiences, particularly Hispanic and Asian viewers. The two platforms account for about a third of total television time for both groups.

Generally speaking, streaming more closely mirrors the makeup of the total TV universe than linear. But looking at individual platforms reveals additional layers of opportunity. We’ve touched on Netflix and YouTube already, but other examples include The Roku Channel and Tubi, which strongly over-index among Black audiences.